Capital gains tax calculator 2020

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Access tax-forward insights tools strategies for maximizing after-tax return potential.

Capital Gains Tax Calculator For Relative Value Investing

If you own the asset for longer than 12 months you will pay 50 of the capital gain.

. If you earn 40000 325 tax bracket per. Tax-deferred accounts include the. Federal Medicare Tax Rate and Rate on Long-Term Capital Gain Combined 2380.

The capital gains tax rates on most assets held for less than one year correspond. Build Your Future With a Firm that has 85 Years of Investment Experience. 2022 Federal Capital Gains Tax Calculator Weve got all the 2021 and 2022 capital gains tax rates in one place.

Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the. 2021 capital gains tax calculator. Ad Discover Helpful Information And Resources On Taxes From AARP.

Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for. The tax rate on most net capital gain is no higher than 15 for most individuals.

Ad Calculate capital gains tax and compare investment scenarios with our tax tools. On the other hand if you held the assets for. Here is how you can calculate tax on capital gains in this case.

SARS Capital Gains Tax Calculator Work out the Capital Gains Tax Payable on the disposal of your Asset. Sourced from the Australian Tax Office. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately.

Calculate your capital gains taxes and average capital gains tax rate for the 2022 tax year. Add this to your taxable. Find a Dedicated Financial Advisor Now.

For example in 2020 the TFSA limit is 6000. Updated for tax year. Enter the purchase and sale details of your assets along with tax reliefs and our capital gains tax calculator will work out your tax bill including all tax rates and allowances.

Federal Medicare Tax and Tax Due on Long-Term Capital Gain Combined 000. DO I HAVE TO PAY. Capital Gains Tax Calculator Values.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Contact a Fidelity Advisor. The tax rate you pay on long-term capital gains can be 0 15 or 20 depending.

Have you disposed of an asset this year. Capital Gains Tax Record Keeping tool This link opens in a new window. This calculator has been decommissioned however you can access a different tool for.

The TDS threshold for AY. 2022 capital gains tax rates. Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Do Your Investments Align with Your Goals. Yes No Not sure Get. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

In 2020 there are capital gains rates of 0 15 and 20 for different assets that you owned for a year or more before selling them. Capital gains are taxed at the same rate as taxable income ie. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. The full value of the consideration received 200 shares Rs 1500 per share. First deduct the Capital Gains tax-free allowance from your taxable gain.

Kiyma Avukat Yokluk What Is Long Term Capital Gain Lahoralatina Net

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

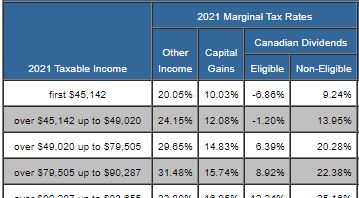

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

How Are Dividends Taxed Overview 2021 Tax Rates Examples

12 Ways To Beat Capital Gains Tax In The Age Of Trump

What S Your Tax Rate For Crypto Capital Gains

Kiyma Avukat Yokluk What Is Long Term Capital Gain Lahoralatina Net

Kiyma Avukat Yokluk What Is Long Term Capital Gain Lahoralatina Net

Harto Operacion Romano One Time Capital Gains Exemption Inicial Arado Ciervo

Taxtips Ca Business 2020 Corporate Income Tax Rates

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains 101 How To Calculate Transactions In Foreign Currency

Capital Gains Tax Calculator 2022 Casaplorer